I admit it’s quite strange to write something like this, 2 months into a new year. Better late than never right?

In the US, everything seems rosy and great -

Economic data is good (boldly writing this pre NFP on March 8th)

Jay Powell is indicating that they won’t hesitate to cut rates if things turn for the worse

Energy and hence inflation, are not problems for the US because

Shale producers are producing vast quantities

The SPR will get tapped in case of higher prices

OPEC+ are sitting on plenty of spare capacity

Seems like the world is getting used to Geopolitical tension and is learning to live with it such as avoiding the Houthis in the Red Sea and Suez canal altogether

Leverage seems to be more concentrated on Govt balance sheets vs private (individual and corporate) balance sheets - unsustainable situation over the long run but this doesn’t mean the reckoning has to take place this year

Hence,

Nothing as far as the eye can see seems like it’s going to cause the Fed to push rates up

We’re in a presidential election year where the incumbent is going to do his best to avoid and minimize economic damage

The reaction to every passing economic data release is getting more and more subdued compared to mid-2022 when the extreme focus started. Markets were trying to forecast the Fed’s every move back then but seems less bothered by it now.

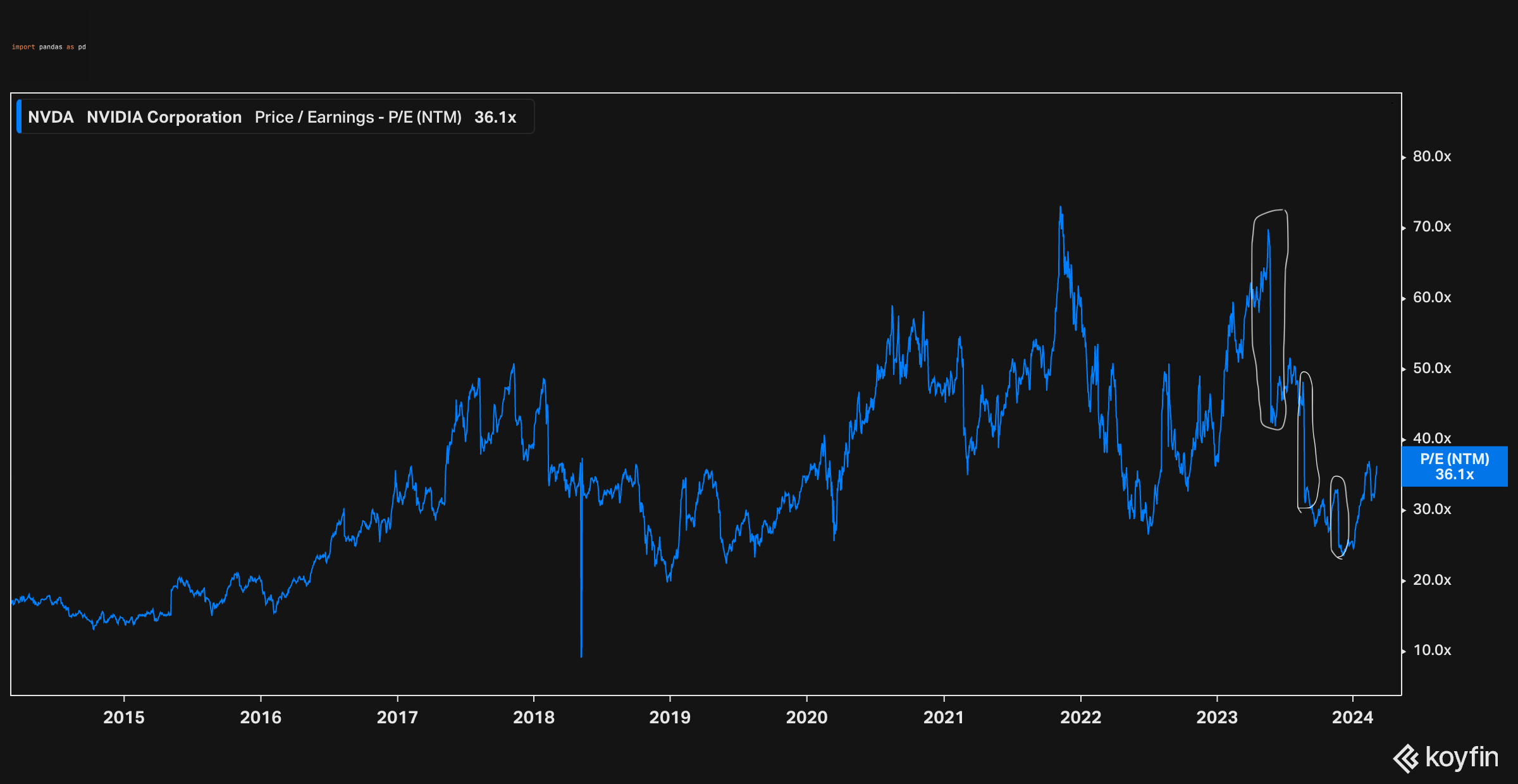

The market and these AI names may look overvalued, but this chart of Nvidia’s P/E ratio shows how these valuations react to earnings. See the highlighted sharp dips in the P/E ratio? Those are because Nvidia grew earnings massively (the denominator in the P/E ratio) which “justifies” these valuations. I’m not saying they can keep up this incredible pace of growth but they’ve justified ridiculous valuations all through last year. Maybe they keep at this pace for another couple of quarters. Who knows.

To summarise,

None of the risks from the last few years seem likely to materialize (i.e. COVID, inflation spike, interest rate spike, etc.)

We’re in an election year so Dems have an incentive to keep the economy juiced

Volatility continues to be low

These are perfect ingredients in the recipe of higher stock prices - add in the distorting effects of passive flows and that should help pump the winners even more.

Stick to the winners

The most obvious winners are AI (only a year late to the party 😊) and weight-loss drugs.

The AI revenue seems to be making its way into the second and third order beneficiaries from niche component manufacturers to AI democratisers.

For instance,

In five years, the market opportunity for 800G and 1.6T datacom transceivers is expected to be greater than all other types of datacom transceivers combined, largely driven by AI and ML.

- Coherent

This is a $9B market cap company at the time of writing and it’s up roughly 50% this year. The majority of the move took place after their earnings call in early Feb. This pattern is going to keep recurring over the course of this year and I personally think it’s going to be difficult to keep the market down with these types of strong earnings releases in the absence of major macro risks.

The other winner in weight-loss drug beneficiaries is causing biotech indicies to move higher. This is extremely impressive given how the expectation and increase in interest rates has put a lid on the biotech sector for about 2 years now. Recent moves seem to be impressively bucking that trend, primarily due to positive clinical trial readouts on weight-loss drug prospects.

This biotech outperformance may feel ordinary in the US or India where stocks have the ability to shake off any uncertainty and move higher. You only need to look at certain other parts of the world where rate cut expectations are having a far larger impact on asset prices. Take the UK for example which experienced a strong move late last year in the face of i) weaker inflation data and ii) the Fed talking about rate cuts in December. That whole move was derailed in January because CPI readings were slightly higher than expected. Gilt yields and hence the overall UK market have been on a rollercoaster alongside Gilt yields since. Gilts I feel are a major factor in the UK’s anaemic stock market performance in recent times and I’ll write about this in a separate post.

In the US however, it feels like the Fed and the datapoints they rely on matter less and less and I expect that to be the case for most of this year. Hence, buy stocks and sit tight is the message for now.

The risks

It’s irresponsible not to consider the risks. I know I said I don’t see very many but after some digging, I think I may have found it. It’s a political risk that may not really play out until post the election but it’s worth keeping an eye on.

Joe Biden is keen on raising taxes in the US and the global minimum tax rate may gather momentum if Biden were re-elected. This could negatively affect a number of corporations who have cleverly set up operations and headquarters around the world with an eye tax minimisation. Just like Trump’s tax cuts spurred on an incredible rally post the 2016 election, I wouldn’t be surprised if a number of companies get hit by the planned tax overhaul.

I don’t know if the markets are going to weigh the probability of Biden’s re-election and hit companies who are likely to get affected accordingly. To me it feels like a post-election move. However, it is good to keep on the radar.

Valuations are on the higher end and hence earnings misses will always be hit harder. I unfortunately am unable to trade options to provide myself high convexity protection to my portfolio, so I’m having to rely on my longer time horizon and position sizing for risk management to handle this and any other un-forecastable risk. I’ll be trigger happy to jump out if I see anything that concerns me.

The most important risk to me is that I’m an idiot and have completely misinterpreted the data. I combat that by investing in a bunch of less volatle, boring, old and steady returners.

My mantra is - Survival > Top decile returns

Good to remember

Roughly 4 years ago, countries were being locked down due to fears over COVID-19. The world and mindsets were wildly different in 2020, 2021 and early 2022 regarding COVID-19 vs how it’s viewed now. Just take a second to think about people who would exercise extreme caution by use of masks, hand sanitiser, disinfectants, vaccinations and contrast them with their lives today. This is not a personal dig at anyone, but more to highlight how people overcome macro events and move on with their lives a lot quicker than market participants think.

I would wager that people care a lot more about the war in Ukraine or the Israel-Gaza conflict a lot more than a bunch of people dying from COVID-19 now.

Similarly, I think that inflation and higher interest rates are going to start taking a backseat in people’s minds. Are inflation levels around 3 or 4% really going to affect us all so badly compared to 2% inflation? If people are able to grow your income or cut spending by similar levels, then they eventually get on with it. Barring another 10% ish inflation spike, I don’t see what keeps everyone’s focus on inflation for too much longer and I think this mindset shift will seep into the politician’s and eventually central bankers’ minds.

The epic maturity walls that will cause major accidents in the credit space due to higher interest rates haven’t materialised yet either. Even if it was fast approaching, people have had a decent amount of time to adapt to it to avoid major accidents.

The US market’s focuses have already shifted it seems like and I think this will be the case worldwide by the end of 2024. So I’m moving on too.

Thanks for reading. Would love to hear from you in the comments or via DM. Most importantly, good luck out there.